does td ameritrade report to irs

What does TD Ameritrade report to IRS. Posted on March 10 2017 by admin.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

TD Ameritrade does not report this income to the IRS.

. Shows the portion of the amount in. Your Consolidated Form 1099 does list income less than 10. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content.

Box 2e - Section 897 ordinary dividends. Log completely out of Turbo Tax. OANDA does not report taxes on behalf of our clients and as a result we do not provide any tax forms relating to profitloss on your account eg.

WKFS and is made available by TD Ameritrade for general reference. Leave a Reply Cancel reply. I recently opened an account with TD Ameritrade.

Prior to 2011 firms such as TD Ameritrade reported only sale proceeds. Box 2e - Section 897 ordinary dividends. Do I need to report anything on my tax return if I havent withdrawn any funds from the account.

The IRS has updated the 2021 Form 1099-DIV to include two new boxes. You as manager of the LLC will then have checkbook control over all the assetsfunds in the IRA LLC to make the investment. What does TD Ameritrade report on Form 1099.

Questions relating to specific tax issues however should be directed to your tax advisor. TD Ameritrade does not report this income to the IRS. Then clear your cache and cookies within your browser and completely close out of it.

TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. TD Ameritrade will report a dividend as qualified if it has been paid by a US. TD Ameritrade does not report this income to the IRS.

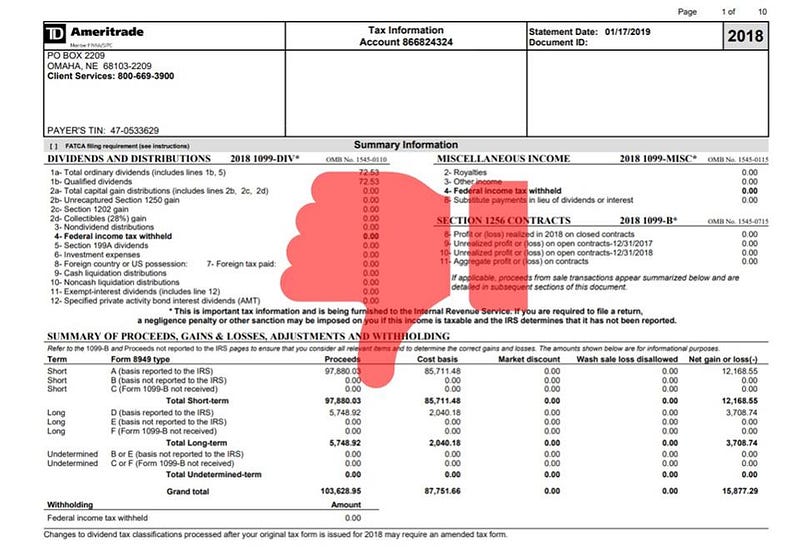

Information in the Supplemental Information section of the Consolidated Form 1099 is provided for your convenience only. What does TD Ameritrade report to IRS. Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD Ameritrade is now required as are all broker-dealers to report adjusted cost basis gross proceeds and the holding period when.

You must enter the gain or loss on sales of securities dividends and interest earned etc. Report Inappropriate Content. Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls around.

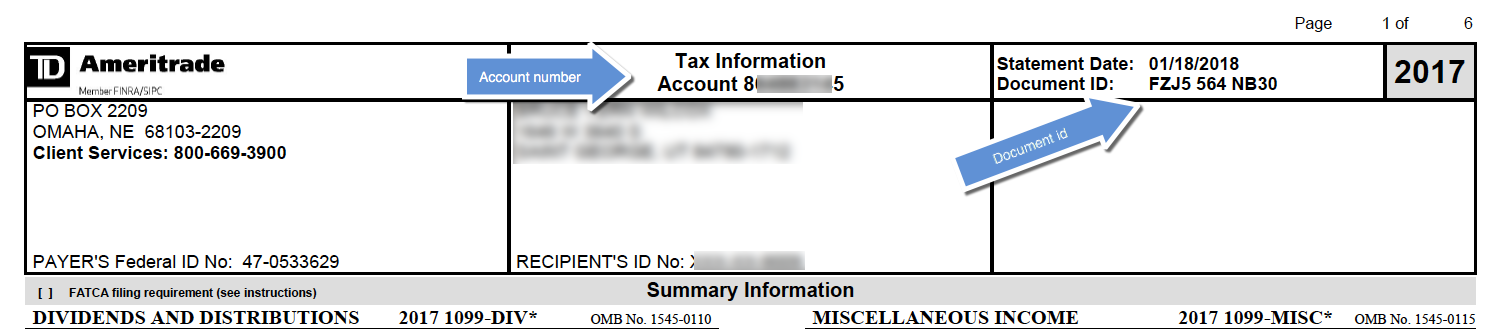

Your Consolidated Form 1099 is the authoritative document for tax reporting purposes. How long does XM deposit take. They dont report the gain or loss to the IRS.

All income and gains from the stock investments will flow back to the IRA without tax. Ask Your Own Tax Question. How long does XM bonus last.

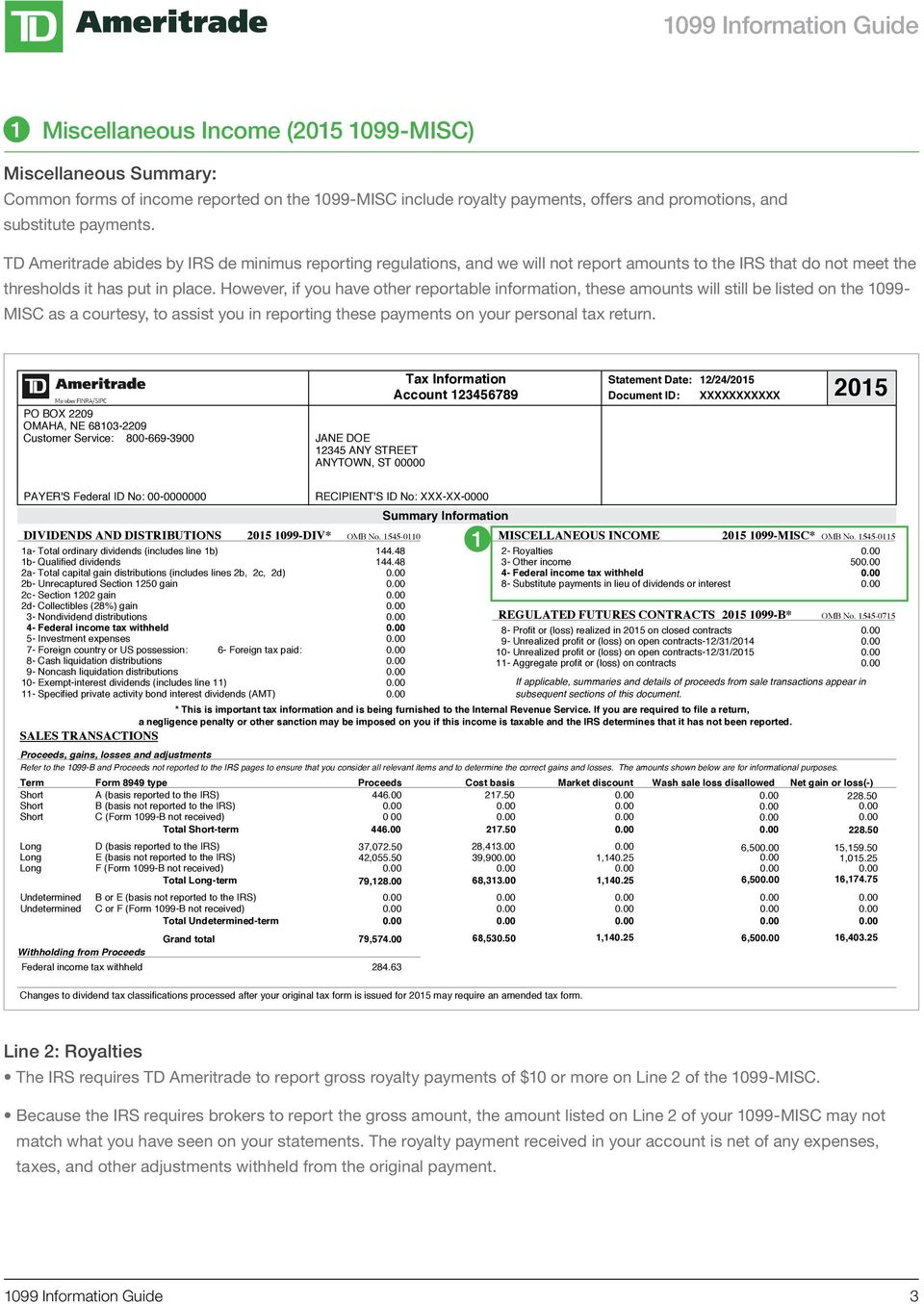

TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. Box 2e and Box 2f. Ameritrade 1099 tax import to Turbotax not working.

Questions relating to specific tax issues however should be directed to your tax advisor. Or qualified foreign corporation and it is readily tradable on a US. Your email address will not be published.

However if you have other reportable information these amounts will still be listed on the 1099-MISC as a courtesy to assist you in reporting these payments on your personal tax return. TD Ameritrade has a special brokerage account for Self-Directed IRA LLC investors. The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost basis and holding period on covered securities to the IRS on their Consolidated Form 1099s when securities are sold.

If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. Best Broker for Beginners and Best Broker for Mobile. TDA will provide you with a form known as a Consolidated.

If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. Name Email. Regardless of whether you withdrew money from your account or not.

But they do report the basis and sale price. Intraday data is delayed at least 20 minutes. Best Broker for Options and Best Broker for Low Costs.

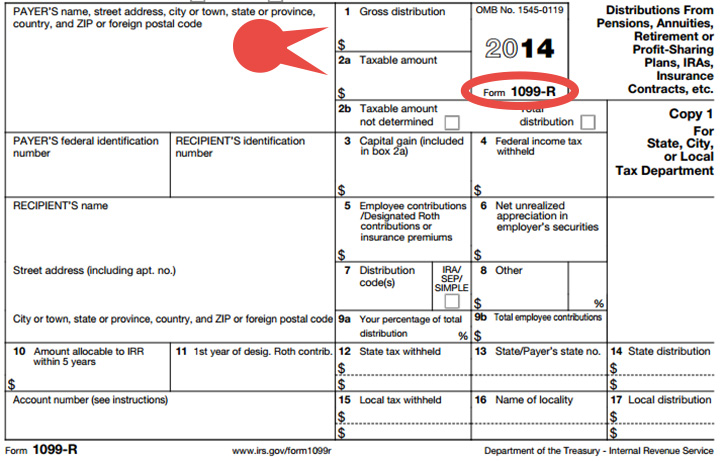

Ad Only 1 day Left to Earn Potential Tax Benefits. In addition to the information reported on a consolidated form 1099 shown at left td ameritrade uses the following forms to report income and securities transactions to the irs. I believe they report columns 1a through 1f on forms 8949 the gain or loss is calculated on column 1g.

I would clear that information out try the following steps below and then try to re-import. However TD Ameritrade does not report this income to the IRS. How long does it take to withdraw from XM to Skrill.

Does Oanda report to IRS. GainsKeeper service and performance reporting is offered and conducted by Wolters Kluwer Financial Services Inc. Open and Fund Your IRA Today.

Required fields are marked Comment. This data can sometimes be cumbersome when served in large quantities but you can export it into Excel or to a printer-friendly page. Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD Ameritrade is now required as are all broker-dealers to report adjusted cost basis gross proceeds and the holding period when certain securities are sold.

The topic of this. TD Ameritrade does not report this income to the IRS.

Logo Td Ameritrade Institutional

How To Read Your Brokerage 1099 Tax Form Youtube

Get Real Time Tax Document Alerts Ticker Tape

Td Ameritrade Ofx Import Instructions

Tax Forms Every Investor Should Know About Novel Investor

1099 Information Guide Pdf Free Download

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape

Deciphering Form 1099 B Novel Investor

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Do Non Us Citizens Need Itin To Trade Stocks On Td Ameritrade And Enjoy Earning From That Quora

Documents To File Your Taxes If You Have An Ira Roth Ira Or Sep By Marc Anselme Anselme Capital Blog Medium

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker